You’ve navigated the legal maze, secured your funding, and perhaps even opened your doors. Your display case is filled with beautiful, delicious creations. Now comes a question that stumps many new bakery owners: How much should you charge? Setting the right price for your baked goods is far more than just covering the cost of ingredients; it’s a strategic decision that directly impacts your bakery’s profitability, brand perception, customer attraction, and long-term survival. Guessing or simply undercutting competitors can quickly lead to financial strain. Mastering the art and science of pricing is essential for turning your baking passion into a sustainable business.

More Than Just Flour and Sugar: Why Strategic Pricing is Crucial

Pricing isn’t an afterthought; it’s woven into the fabric of your business strategy. Effective pricing helps you:

- Ensure Profitability: The most obvious goal – prices must cover all costs and leave a margin for profit, allowing you to reinvest in the business, pay yourself, and grow.

- Communicate Value: Price sends a powerful message. Is your bakery a source of affordable everyday treats, or a high-end destination for artisanal creations? Your pricing must align with the value you offer.

- Attract Your Target Customer: Pricing filters your audience. Setting prices appropriate for your niche and target market (identified in earlier planning stages) helps attract the right customers who appreciate what you offer.

- Compete Effectively: Understanding how your prices stack up against competitors helps you position your bakery strategically in the local market.

- Manage Cash Flow: Consistent, profitable pricing contributes to healthy cash flow, ensuring you can pay suppliers, rent, and employees on time.

Common pricing pitfalls include underpricing out of fear or lack of confidence, failing to account for all costs (especially labor and overhead), or blindly matching competitors without understanding your own financial needs.

Step 1: Calculate Your True Costs – The Foundation of Pricing

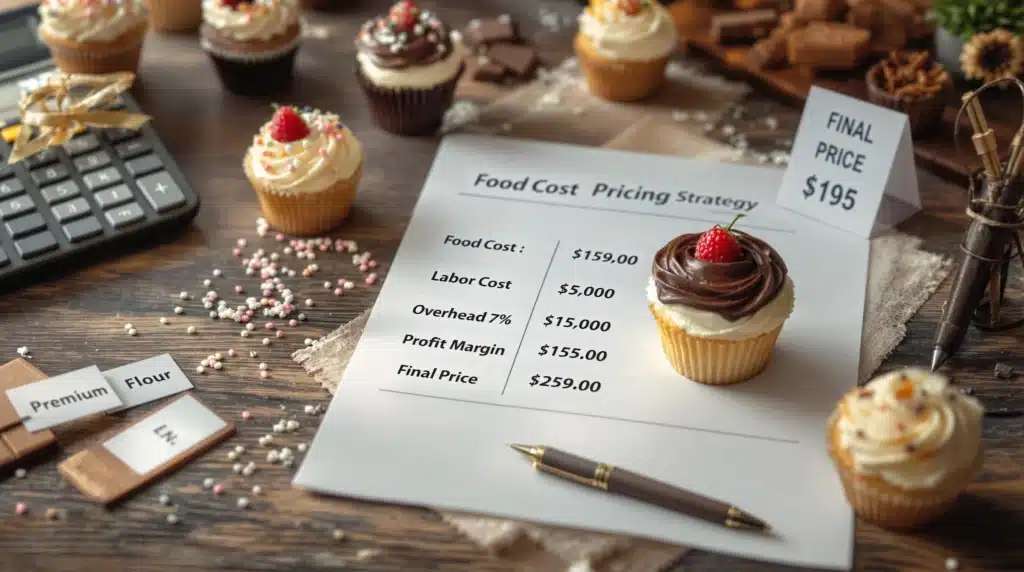

Before you can set a profitable price, you must know exactly what it costs to produce each item. This involves breaking down costs into three main categories: food cost, labor cost, and overhead.

Food Cost (Cost of Goods Sold – COGS)

This is the direct cost of the ingredients used in a specific recipe. Accuracy here is vital.

- Precise Recipe Costing: Standardize your recipes with exact weights and measures. Don’t guess.

- Calculate Ingredient Cost: Determine the cost per unit for each ingredient.

- Find the purchase price of the ingredient (e.g., $50 for a 50lb bag of flour).

- Determine the usable unit (e.g., cost per pound: $50 / 50 lbs = $1.00/lb; cost per ounce: $1.00 / 16 oz = $0.0625/oz).

- Factor in yield/waste if necessary (e.g., if you lose 10% of a fruit’s weight to peeling, adjust the cost per usable ounce accordingly).

- Cost the Full Recipe: Multiply the amount of each ingredient used in the recipe by its cost per unit. Sum these up to get the total recipe cost.

- Cost Per Item/Serving: Divide the total recipe cost by the number of items the recipe yields (e.g., cost per cookie, cost per cupcake, cost per slice of cake).

Simple Example: Costing One Chocolate Chip Cookie

- Recipe yields: 24 cookies

- Ingredient Costs (Illustrative):

- Flour (10 oz @ $0.0625/oz) = $0.625

- Butter (8 oz @ $0.25/oz) = $2.00

- Sugar (7 oz @ $0.05/oz) = $0.35

- Eggs (2 @ $0.20/egg) = $0.40

- Vanilla (1 tsp @ $0.50/tsp) = $0.50

- Baking Soda/Salt (negligible, or calculate if significant) = ~$0.05

- Chocolate Chips (12 oz @ $0.30/oz) = $3.60

- Total Recipe Cost: $7.525

- Food Cost Per Cookie: $7.525 / 24 cookies = $0.314 (approximately 31 cents)

Keep a detailed spreadsheet for all your recipes!

Labor Cost

This is often the most underestimated cost, especially if you’re the sole baker initially. You must pay yourself!

- Direct Labor: The time spent directly producing the item – mixing, scooping, shaping, baking, decorating, slicing.

- Determine a realistic hourly wage for this work (include payroll taxes, worker’s comp, benefits if applicable – typically add 20-30% on top of base wage for these burdens). Let’s say $20/hour fully burdened.

- Track how long it takes to make a batch (e.g., 1 hour total active time for the cookie batch).

- Calculate labor cost per batch: $20/hour * 1 hour = $20.00

- Calculate labor cost per item: $20.00 / 24 cookies = $0.833 (approximately 83 cents per cookie)

- Indirect Labor: Time spent on essential tasks not tied to a specific product – cleaning, ordering supplies, bookkeeping, customer service, managing staff. This is usually factored into overhead (see below).

Overhead Costs (Indirect Costs)

These are all the other expenses required to keep your bakery running, which need to be allocated across the products you sell.

- Examples: Rent, utilities (electricity, gas, water), business insurance, licenses and permits, marketing and advertising costs, website hosting, POS system fees, telephone/internet, cleaning supplies, office supplies, smallwares (pans, utensils – amortized), equipment depreciation, loan repayments, professional fees (accountant, lawyer), owner’s salary/draw (non-production time), salaries for managers, counter staff, delivery drivers, etc.

- Allocating Overhead: This can be complex. A simple approach for starting is to understand that your selling price must cover food cost, direct labor cost, and contribute towards these overheads, plus generate profit. Many bakeries track overhead as a percentage of total sales over time. Another method involves estimating total monthly overhead and dividing by estimated total monthly direct labor hours to get an overhead rate per labor hour, which is then added to product costs. For simplicity initially, focus on ensuring your pricing strategy (covered below) generates enough revenue above food and direct labor costs to cover all these items.

Putting Costs Together (Example Cookie):

- Food Cost: $0.31

- Direct Labor Cost: $0.83

- Total Prime Cost (Food + Direct Labor): $1.14 Your selling price needs to be significantly higher than $1.14 to cover overhead and make a profit.

Step 2: Understand Value Perception – What Will Customers Pay?

Cost is only one piece of the puzzle. You also need to consider what your target customers perceive as fair value for your product.

- Price as a Quality Signal: In the absence of other information, customers often use price to judge quality. Extremely low prices might make customers question ingredient quality or freshness. Higher prices can signal premium ingredients, expert craftsmanship, or a unique experience.

- Target Audience Expectations: Who are you trying to reach? Customers seeking value-priced family treats have different price expectations than those seeking gourmet, artisanal pastries for a special occasion. Your pricing needs to resonate with your chosen niche.

- Brand Positioning: Is your bakery branded as luxurious, wholesome, convenient, traditional, or cutting-edge? Your pricing should feel consistent with this overall brand identity. A mismatch can confuse customers.

- Uniqueness and Niche: Do you offer something competitors don’t? (e.g., authentic French macarons, elaborate custom cakes, exceptional gluten-free bread, unique flavor combinations). This uniqueness often allows for premium pricing because customers can’t easily get it elsewhere.

Step 3: Analyze Your Competitors – What’s the Market Rate?

While you shouldn’t blindly copy competitors, you must be aware of their pricing.

- Identify Key Competitors: Who are your closest competitors in terms of product offerings, quality level, and target audience? Include direct bakeries and indirect competitors (e.g., grocery stores with good bakery sections, cafes).

- Research Their Prices: Visit their locations or check websites/online menus. Note prices for items comparable to yours. Pay attention to portion sizes and presentation.

- Analyze Their Strategy: Are they positioned as budget-friendly, mid-range, or premium? How does their perceived quality compare to yours?

- Position Yourself Strategically: Use competitor pricing as a benchmark. If your costs are similar, pricing too far below might be unsustainable. If you price significantly higher, be prepared to clearly justify why (superior ingredients, more skilled labor, unique offering, better ambiance/service). Understand the price range customers expect for certain items in your local market.

Step 4: Choose Your Pricing Strategy – Putting It All Together

Combine your cost analysis, value perception, and competitor awareness to select a pricing strategy. Often, businesses use a blend of these.

- Cost-Plus Pricing:

- Method: Calculate your total prime cost (Food + Direct Labor), then add a markup percentage to cover overhead and profit. (e.g., Prime Cost $1.14 + 200% markup = $1.14 * 3 = $3.42 selling price). Or, calculate all costs (including allocated overhead) per item and add a profit margin %.

- Pros: Ensures costs are covered, straightforward.

- Cons: Ignores perceived value and competitor pricing; might lead to underpricing or overpricing relative to the market.

- Value-Based Pricing:

- Method: Price based primarily on the perceived value to the customer. What is the maximum they are willing to pay for the quality, uniqueness, convenience, or experience you offer?

- Pros: Can achieve higher profit margins, rewards strong branding and unique offerings.

- Cons: Requires a deep understanding of your customers and confidence in your value proposition; can be harder to calculate initially.

- Competition-Based Pricing:

- Method: Set prices mainly based on competitor prices for similar items (pricing slightly below, at, or slightly above).

- Pros: Simple, keeps you competitive in the market.

- Cons: Doesn’t guarantee profitability if your costs differ significantly from competitors; can lead to price wars; doesn’t highlight your unique value. Best used as a reference point.

- Target Food Cost Percentage Pricing:

- Method: A very common approach in food service. Decide on a target food cost percentage (often 25-35% for bakeries, but this varies based on niche and overhead structure). Calculate the selling price needed to achieve this percentage.

- Formula: Selling Price = Recipe Food Cost / Target Food Cost Percentage

- Example: Using the $0.314 cookie food cost and a 30% target food cost: Price = $0.314 / 0.30 = $1.05. BUT REMEMBER: This $1.05 price must also cover the $0.83 labor cost, plus overhead, plus profit. In this example, a 30% food cost target is clearly too low for this specific high-labor cookie unless overhead is minimal. You might need to aim for a higher price (resulting in a lower food cost percentage) or find ways to reduce food/labor costs. Let’s re-run with the target price found earlier ($3.42): Food Cost % = $0.314 / $3.42 = ~9.2%. This indicates a higher-value item where labor/skill/overhead makes up more of the cost.

- Pros: Industry standard, helps control a key variable (food cost).

- Cons: Requires careful consideration to ensure the resulting price adequately covers all other costs (labor, overhead) and profit. Target percentages need to be set realistically based on your overall cost structure.

Practical Pricing Tips for Your Bakery

- Offer Tiered Pricing: Provide options like small/large sizes, basic/premium versions, or individual items vs. packs.

- Use Bundling: Create value perception with combos (e.g., “Coffee & Muffin Deal,” “Baker’s Dozen” – 13 items for the price of 12).

- Consider Psychological Pricing: Using prices ending in .99 or .95 can sometimes increase sales for certain market segments, but might detract from a premium image. Test what works for your brand.

- Implement Menu Engineering: Regularly analyze sales data vs. profitability for each menu item.

- Stars: High Profit, High Popularity (Promote them!)

- Puzzles: High Profit, Low Popularity (Try renaming, describing better, or repositioning)

- Plowhorses: Low Profit, High Popularity (Consider a slight price increase if possible, or reduce costs)

- Dogs: Low Profit, Low Popularity (Consider removing from the menu unless strategically important)

- Account for Hidden Costs: Factor in the cost of packaging (boxes, bags, labels), credit card processing fees (often 2-3% of the sale), and potential delivery costs/commissions.

- Review and Adjust Regularly: Ingredient prices fluctuate, labor costs increase, competitor actions change. Review your costs and pricing structure at least annually, or whenever major cost changes occur. Don’t be afraid to adjust prices to maintain profitability, but always focus on communicating the value you provide.

Pricing for Profit: Your Sweet Spot for Sustainability

Pricing your baked goods is a dynamic process, not a one-time task. It requires a solid understanding of your costs, keen awareness of your market and customers, and strategic decision-making. By carefully calculating costs, considering perceived value, analyzing competitors, and choosing an appropriate strategy, you can find the pricing “sweet spot” that not only attracts customers but also ensures the financial health and long-term success of your bakery dream. Profitable pricing isn’t greedy; it’s necessary for sustainability.